utah food tax calculator

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The median annual property tax paid by homeowners in Utah County is 1517.

Indiana Sales Tax Calculator Reverse Sales Dremployee

You sell milk and bread to a customer.

. Utah Hourly Paycheck Calculator. Calculate your Utah net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Utah paycheck calculator. Switch to Utah salary calculator.

The Utah tax calculator is updated for the 202122 tax year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. These items are grocery food so you collect tax at the grocery food rate 3 percent at checkout.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For State Use and Local Taxes use State and Local Sales Tax Calculator. Utah has a higher state sales tax than 538 of states.

Utah Salary Paycheck Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Utah local counties cities and special taxation districts. Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes.

Depending on local jurisdictions the total tax rate can be as high as 87. Utah Code 59-12-10295 defines utensils as a plate knife fork spoon glass cup napkin or straw. Total rates in Utah county which apply to assessed value range from 0907 to 1451.

Our Utah State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 3000000 and go towards tax. The restaurant tax applies to all food sales both prepared food and grocery food. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. Utah Salary Tax Calculator for the Tax Year 202122. How 2022 Sales taxes are calculated in Draper.

Net Price is the tag price or list price before any sales taxes are applied. Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

Sales taxes in Utah range from 610 to 905 depending on local rates. The Utah State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Utah State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Report and pay this tax using form TC-62F Restaurant Tax Return.

Details of the personal income tax rates used in the 2022 Utah State Calculator are published below the calculator this. That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median. Calculate a simple single sales tax and a total based on the entered tax percentage.

This Utah hourly paycheck calculator is perfect for those who are paid on an hourly basis. For security reasons TAP and other e-services are not available in most countries outside the United States. The state of Utah has a single personal income tax with a flat rate of 495.

In the state of Utah the foods are subject to local taxes. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Start on editing signing and sharing your Utah Sales Tax Monthly Report For Food And Food online with the help of these easy steps.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. How 2021 Sales taxes are calculated in Draper. You may use the following worksheet to calculate your Utah use tax.

There is no city sale tax for Draper. How to Edit The Utah Sales Tax Monthly Report For Food And Food easily Online. See Pub 25 Sales and Use Tax for more information.

You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 202122. Total Price is the final amount paid including sales tax. You sell milk bread and clothing in one transaction.

The Utah Department of Revenue is responsible for publishing the latest Utah State Tax. In Provo the total rate is 1136. The Draper Utah general sales tax rate is 485The sales tax rate is always 725 Every 2022 combined rates mentioned above are the results of Utah state rate 485 the county rate 135 and in some case special rate 105.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Our calculator has been specially developed in order to. Our Utah Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Utah and across the entire United States.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Employer The restaurant tax is an additional 1. Overall taxpayers in Utah face a relatively low state and local tax burden.

This calculator will calculate the interest you owe for Utah tax obligations. Push the Get Form or Get Form Now button on the current page to make access to the PDF editor. The Utah Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Utah State Income Tax Rates and Thresholds in 2022.

While this calculator can be used for Utah tax calculations by using the drop down menu provided you are able to change it to a different State. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The current total local sales tax rate in Provo UT is 7250.

Back to Utah Sales Tax Handbook Top. It does not contain all tax laws or rules. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

Grocery food does not include alcoholic beverages or tobacco. Both food and food ingredients will be taxed at a reduced rate of 175. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. The tax on grocery food is 3 percent. The Utah UT state sales tax rate is 47.

Psd Mockup Interface Dark Gui Psd Interface Graphing Calculator Web Design

Income Tax Calculator 2020 2021 Estimate Return Refund

Food Truck Revenue Projection Template Plan Projections Starting A Food Truck Food Truck Business Plan Food Truck Business

Workshops Tools Food Business Ideas Home Bakery Business Cookie Business

Tax Calculator App Smartphone Interface Vector Template Stock Illustration Download Image Now Istock

2020 Tax Reference Guide Reference Annuity Tax

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Calculato Home Equity Loan Home Equity Loan Calculator Formula

Pin By Keri On Food College Graduation Parties College Grad Party Graduation Party

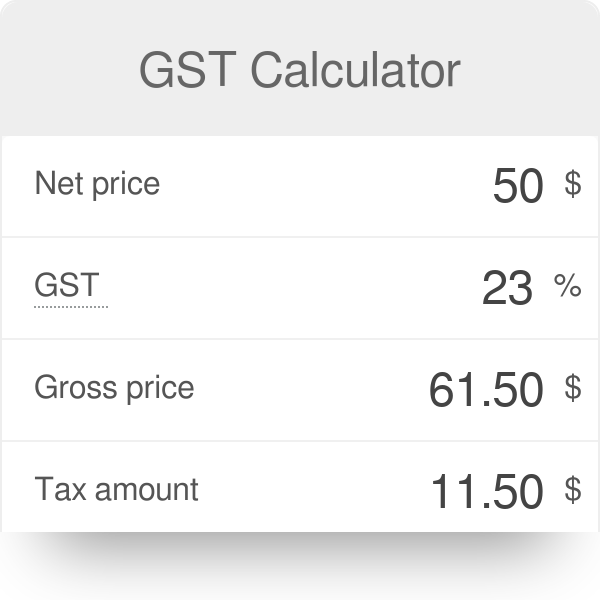

Gst Calculator How To Calculate Gst

Small Food Business Food Product Cost Pricing Calculator Food Business Ideas Food Truck Business Pricing Calculator

Ors Child Support Calculator Utah Child Support Quote Calculate Child Support Payment Between You And Child Support Quotes Child Support Child Support Laws

How To Calculate Sales Tax On Calculator Easy Way Youtube

How To Calculate Sales Tax Definition Formula Example

Download Key Business Concept With Infographic Design For Free In 2021 Infographic Design Infographic Design

Best Hot Dogs Landing Page Vector Landing Page Best Homepage Layout

How To Calculate Sales Tax Video Lesson Transcript Study Com

Infographic A Snapshot Of American Bankruptcy Infographic Bankruptcy Financial Checklist